You Paid Off Your Home. Why Does Your Credit Report Still Say You’re Late?

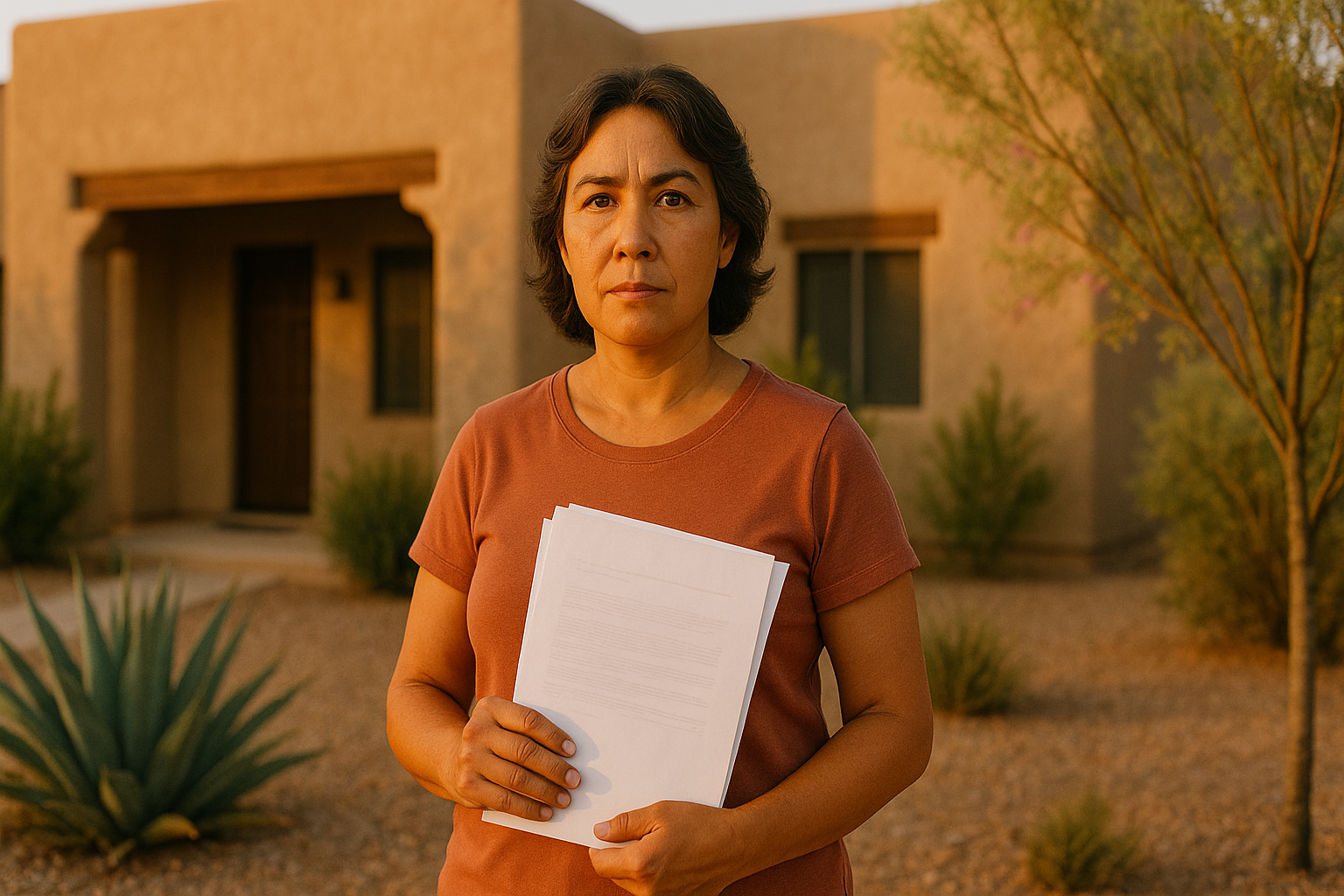

For many rural families in Texas and New Mexico, a USDA mortgage was the only way to buy a home. You worked hard, made every payment, and finally paid off the loan. That should have been a moment of pride — your home, free and clear.

But then you check your credit report and see something shocking: the USDA still shows your account as past due, sometimes even “120 days late.” Instead of celebrating, you’re fighting to clear your name.

If this sounds familiar, you are not alone. And you do have rights.

Who Faces This Problem Most Often?

We’ve seen this problem come up most for people like:

- Retirees on fixed income who took out a USDA Section 502 Direct loan decades ago and just paid it off.

- Families in rural areas and colonias across Texas and New Mexico who used USDA financing when other lenders said no.

- Women homeowners — often single mothers or widows — who should be rewarded for paying off their homes, not punished.

- Hispanic and Latino households in border communities, as well as long-time rural homeowners throughout the state.

These borrowers did everything right, but the system let them down.

How Does This Mistake Happen?

Here’s what usually goes wrong:

- USDA, through its loan servicing arm, continues to report the account as “active.”

- Instead of showing “paid in full,” the report gets coded as delinquent.

- When the borrower files a dispute with the credit bureaus, the error often sticks because USDA fails to correct the record.

This isn’t a missed payment or a misunderstanding. It’s a reporting mistake — and it can do real damage.

Why This Error Hurts So Much

A false delinquency on your credit report can:

- Raise your insurance rates for cars and homeowners coverage.

- Block you from getting credit cards or loans — even small ones for emergencies.

- Stop you from co-signing for your children or grandchildren.

- Undermine your dignity. After a lifetime of responsibility, your crowning achievement is turned into a black mark.

The Supreme Court Steps In: The Kirtz Case

In 2024, the U.S. Supreme Court decided a case called Kirtz v. USDA. The borrower, like many rural homeowners, had paid off his USDA loan in full — yet USDA still reported him as 120 days late. When he sued, USDA claimed it was immune because it’s a federal agency.

The Court unanimously disagreed. It ruled that under the Fair Credit Reporting Act (FCRA), federal agencies like USDA can be held accountable just like any bank or credit union. That means rural borrowers now have a clear path to fight back when their credit is damaged by this kind of mistake.

What You Can Do If It Happens to You

- Get your credit reports. You’re entitled to free reports from Equifax, Experian, and TransUnion at annualcreditreport.com.

- Look for errors. If your USDA loan says “delinquent” or “past due” after it’s been paid off, that’s a red flag.

- File a dispute. Send a written dispute to the credit bureaus explaining the loan was paid in full.

- Document everything. Keep copies of your payoff letter and dispute letters.

- Seek legal help if it isn’t fixed. Under the FCRA, you have the right to sue for damages — and now USDA cannot hide behind immunity.

How We Help Texans and New Mexicans

Our firm represents rural homeowners in Texas and New Mexico who are caught in exactly this situation. We know USDA programs, we know rural housing law, and we know the FCRA.

- No out-of-pocket costs. The FCRA makes USDA (not you) pay attorney fees when we win.

- Local knowledge. We understand the unique challenges of colonias, small towns, and rural service areas.

- Real results. We’ve helped families clear their names and restore their credit after years of faithful payments.

You worked too hard to let a mistake tarnish your record.

Take the Next Step

If you live in Texas or New Mexico and your USDA loan was paid off but is still showing as delinquent, you don’t have to face this alone.

📞 Call us today for a free case review, or fill out our online form. We’ll listen to your story, review your credit report, and fight to make it right.

Closing Note

A paid-off home should be a badge of honor, not a burden. Don’t let USDA’s mistake rob you of the credit you deserve. The law is on your side — and we’re here to help.

¿Habla español? También hablamos español. Llámenos hoy.